At least one prime minister has resigned, another in under fire, and Canada’s tax chief and has ordered Revenue Canada officials to get their hands on the information contained in the so-called “Panama Papers.”

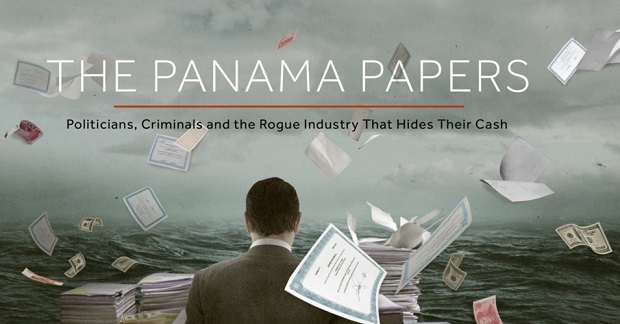

These were some of the developments yesterday following the leak of some 11.5 million documents from the Panamanian law firm Mossack Fonseca, detailing the use of offshore tax havens by heads of states, famous athletes, billionaires, and organizations. The papers came out in an investigative report published on Sunday by the International Consortium of Investigative Journalist (ICIJ) and several media outlets including the CBC, the Canadian Press and the German newspaper Süddeutsche Zeitung.

Among those named by the ICIJ for their offshore dealings are relatives of Chinese leader Xi Jinping, close associates of Russian President Vladimir Putin, Iceland’s Prime Minister Sigmundur David Gunnlaugsson, and Barcelona striker Lionel Messi.

RELATED CONTENT

Offshore accounts of Putin associates, celebs and rich Canadians exposed in data leak

Wealthy tax dodgers get amnesty from CRA: Report

In Iceland, Prime Minister Sigmundur David Gunnlaugsson is resigning his post, according to his party. It appears Gunnlaugsson is the first political casualty in massive document leak which revealed his wife held an unreported offshore account with Mossack Fonseca

In a country with a population of some 323,000, an estimated 23,000 rioted outside Iceland’s parliament on Monday and pelted the building with bananas — the protesters’ new symbol for corruption tied to offshore tax havens.

Gunnlaugsson’s resignation was announced ahead of a planned vote of no-confidence. Sigurdur Ingi Johannsson, deputy leader of Gunnlaugsson’s Progressive Party, said the party will suggest to its coalition partners that he himself should be named the new prime minister.

In China, the Beijing government announced that reports of the families of President Xi Jinping and other current and former Chinese leaders having links to offshore accounts were “groundless.”

In Canada, Revenue Minister Diane Lebouthillier instructed Canada Revenue Agency officials to “obtain the list of data” leaked through the Panama Papers.

A spokesperson for the CRA told the Toronto Star that agency intends to cross-reference the Panama Papers information with data the CRA already has.

The ICIJ reported that confidential records held by the Mossack Fonseca, which specializes in setting up shell companies, records of some 350 Canadians who use the company’s services.

While it is not illegal for Canadian taxpayers to have foreign investments, these investors are required to report all their income earned outside the country to the CRA.

Since 2015, the CRA has collected information on international fund transfers worth more than $10,000. The CRA said it selects “high risk” taxpayers for review or audit.

In the United States, President Barack Obama said the Panama Papers had shown a spotlight on the problem of tax avoidance.

“We’ve had another reminder in this big dump of data coming out of Panama that tax avoidance is a big global problem,” he told the media. “It’s not unique to other countries because frankly there are folks here in America that are taking advantage of this same stuff. A lot of it’s legal, but that’s exactly the problem.”

In the United Kingdom, the government came under pressure from the Labour Party to impose “direct rule” on British overseas territories and dependencies that do not comply with U.K. tax laws.

U.K. Prime Minister David Cameron came under fire when it was learned through the Panama Papers that his late father, Ian, used offshore trading techniques to set up a fund for investors.

In Russia, the Kremlin suggested that the leak which showed close friends of Putin have as more than $2 billion in offshore accounts were a U.S. plot aimed at discrediting the Russian president.

Putin, Russia, our country, our stability and the upcoming elections are the main target, specifically to destabilize the situation,” a Kremlin spokesperson said.