The Conservative Party of Canada has released its official platform for the April 28th general election. It’s called “Change”. The subtitle is his party’s opening slogan, “Canada First – For a Change”. This is the message leader Pierre Poilievre has been promoting as his ‘ballot question’. Accordingly, the platform seeks to distinguish its offerings from the record and approach of the Liberal party government.

You can read the whole platform here.

At a Glance

The platform is 30 pages long, about half the length of the Liberal party’s platform released last week. It contains 223 specific initiatives, including another 16 as part of its “Quebec Platform”, the only province to get its own section. It also contains a “Fiscal Track” section; two pages of tables to show the impact of promises on reducing the deficit.

Overall, the platform is divided into seven sections.

- Axe the Tax and Make Life Affordable

- Build the Homes

- Stop the Crime

- Fix the Budget to Kill Inflation

- Stand up for Canada

- Make Life Better for All Canadians

- Protect our Shared Canadian Identity.

For those following the election campaign, there are few new promises. Much has been presented already. A proposed Taxpayer Protection Act, requiring a referendum before any tax hikes, is the most novel addition.

Positioning

The overall positioning of the platform sticks with the established themes of the Conservative campaign: financial affordability, tax relief, housing, crime and economic growth. This was well-telegraphed before the election with their 2024 slogans of: Axe the Tax, Build the Homes, Fix the Budget, and Stop the Crime.

In contrast to the Liberal party’s focus on US tariffs, the word “Trump” appears only three times in the whole document. Tax appears more than 50 times, by contrast. From a political perspective, the platform keeps a strong focus on their current voting coalition, hoping to use contrast with the Liberals on these issues to boost turnout their way.

An opening message from Pierre Poilievre makes Conservative priorities clear in their plan:

- Cuts the Liberal deficit by 70% with less spending on bureaucracy, consultants, foreign aid, and handouts to insiders and special interests, while boosting growth with resource jobs.

- Lowers income tax 15%, saving the average worker $900 and average working family $1,800.

- Builds 2.3 million homes by axing home sales taxes and paying cities to cut other taxes to save $100,000, selling off federal land, and getting gatekeepers out of the way to speed up homebuilding.

- Locks up criminals to make you safe.

- Puts Canada First–For a Change.

Identifying deficit reduction as the number one item is a revealing choice. It is certainly meant to contrast with the higher explicit spending promises of the Liberal platform. But it also admits it will not balance the budget in its first term in government, putting forth a “70%” reduction but not an actual elimination of the deficit. No party has formally promised to do this within a specific time frame.

Fiscal Track

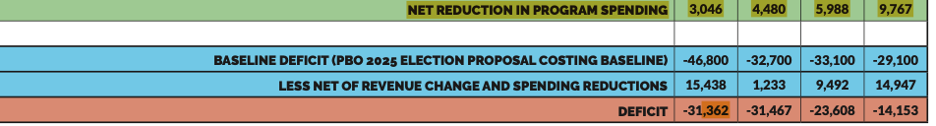

No platform these days can be released without some form of financial accounting for its promises. The CPC provides a two page “Fiscal Track” section with an itemized list of revenue and spending from key measures. These are projected out over four fiscal years, from 2025/25 to 2028/29. Costing estimates were provided by the Parliamentary Budget Office and the party had two external reviewers independently assess “the calculations and assumptions underlying individual measures and the overall fiscal framework” to “confirm they are reasonable and consistent with research conducted in these areas.”

The overall fiscal accounting is less detailed than the Liberal platform. There is no list of key assumptions and variables such as GDP growth, inflation, and so forth. It projects positive revenue growth in the first, third, and fourth years of the fiscal period. These are due to tariff revenue in Year 1 and economic growth revenues in the outer years. Stacking these up against proposed spending reductions in government programs, the CPC projects the following deficit reduction results:

This is the financial basis for considering what a Conservative government would mean for federal public servants and the size and scope of government.

Public Service Implications

The platform takes aim at government “waste” as a prime target for savings.

“We’ll end waste, cap spending, and review all government spending to demand real results for every tax dollar.” To do this, it proposes what it calls “fiscal common sense” and “spending discipline”. To accomplish this, the platform promises to:

“Pass a one-for-one spending law. For every new dollar spent, an equal amount must be reduced.

Cut red tape by 25% and bring in a two-for-one rule. We will reduce regulations by 25% within two years, and ensure going forward that two regulations are eliminated for every new one.

We will also ensure that for every $1 of new administrative burden, $2 is removed. The Auditor General will be required to verify that we deliver on these commitments.”

It clarifies later in the document the one-for-one spending law by saying: “Any new spending must be offset by reduced or new revenues.” (emphasis added).

So, increased government revenues from other sources (the spending constraint is not an initiative-specific tied measure) could allow for an overall increase in spending. Nevertheless, future Conservative budgets could anticipate having a section showing how new program spending (as opposed to continuation of existing program spending) is being offset by reductions elsewhere or an increase in overall government revenues. The direct alignment is not clearly made in the platform.

Unsurprisingly, government bureaucracy (“bloated bureaucracy”) gets attention as a target for reduction and change. But not as deliberately as might be anticipated. Program spending will be actively reduced, but not the size of the public service. Instead, natural attrition will be the instrument. (Note: Both Poilievre and Carney are vying to represent Ottawa-area ridings).

The CPC platform states it will:

“Streamline the federal public servicethrough natural attrition and retirement with only 2 in 3 departing employees being replaced.”

| 2025-26 | 2026-27 | 2027-28 | 2028-29 | Fiscal Year |

| 0 | $60 | $1,416 | $2,850 | Savings in Billions |

The main explicit focus on reducing government spending is on consultants. “We will cut spending on consultants to save $10.5 billion.”, it states. The Fiscal Track section sets it out as “Return Spending on External Consultants to 2015 Levels”:

| 2025-26 | 2026-27 | 2027-28 | 2028-29 | Fiscal Year |

| $1,347 | $4,307 | $7,374 | $10,508 | Savings in Billions |

There is no commitment to a formal program and service review or any governance process or mechanism to do achieve this or other savings, unlike the Liberal platform.

Unlike the Liberal platform, there is only one new government entity being proposed: a Canadian Indigenous Opportunities Corporation. Like the Liberals, the Conservatives propose to streamline government procurement. Unlike the Liberals, however, there would be no stand-alone agency focusing on defence procurement. The CPC platform states:

“Streamline procurement by re-establishing the cabinet committee on military procurement and creating a new PCO-secretariat to ensure that military procurement issues are central in the machinery of government.”

This measure would save between $400 and $500 million per fiscal year, according to their platform.

The CPC platform stipulates other measures that affect public servants and the way business is conducted. These include:

- Eliminate university degree requirements for most federal public service roles to hire for skill, not credentials.

- Ban “double-dipping” so federal officials can’t also profit from government contracts.

- Use plain language laws so legislation is clear, enforceable, and accessible.

There are no specific investment promises for the public service, such as for IT or training.

Assessment

The Conservative Party platform is a less comprehensive document than the Liberal platform. That makes it no better or worse. It is a more ‘communications friendly’ effort with familiar items and wording for anyone following their campaign. Platforms are political documents, not budgets, so they focus on the campaign narrative the party wants. In this case, Donald Trump’s tariffs are not the focus. The Conservatives decided not to compete with the Liberals on this ground and are digging in, instead, on their core issues of affordability, growth, public safety, and housing. All wrapped up in the mantle of “change”. That is why the word “Liberals” appears more than 40 times in the document.

There is no question, though, a new Conservative government would change the policy priorities from the current Liberal government. This will require the public service to step up significantly from current approaches to consider and implement these new directions. The public service will be challenged to find effective ways to do so as goals, rather than mechanisms, are mostly set out in the platform.

Specific program funding cuts, such as for the CBC and the Housing Accelerator Fund, will have to be implemented in a way that savings can be booked in the proposed fiscal years of the Conservative Fiscal Plan. This doesn’t always work out as smoothly as promised or anticipated. Legal and funding obligations cannot be rolled back without due process. And But at least directionally, the Conservatives are clear as to what and when they want things to occur. Public servants would have to find ways to advise on how to accomplish this without undue disruption.

Still, the gradual deficit elimination track set out comes with a lot of unknowns. Economic growth in Canada, America, and the global economy is under duress due to Trump’s tariff policy. This could squeeze federal finances much more than anticipated. Either way, key Conservative commitments to fast-track energy infrastructure and new housing will be essential to help offset this. Repealing a number of laws such as Bill 69 or drafting new bills to allow for “shovel-ready” construction and faster environmental reviews, will make the policy development and consultation processes very challenging in tight timeframes.

The culture of the public service could expect to change under a new Conservative government. There is no talk of “investing” in the public service as an institution or finding ways to improve productivity. This feels like a classic ‘view from the Opposition’ perspective and is therefore unsurprising. Still, demanding “plain language” communications from government and more “skilled” rather than “credentialed” public servants suggest a discomfort with the current culture. Building mutual trust will be essential for both sides to work effectively together.